How much do you need to retire

And more...

Guide published: 6 April 2023

23/24 tax year

Preparing for your retirement can be emotionally and financially challenging. There are some significant choices to make and complex tax rules to navigate. With this guide, you can retire with confidence, learn how to harness your pension effectively and make use of tax wrappers.

We’ll Explore

- The income needed for a ‘comfortable’ retirement

- How much you need

- Generating a 72% risk free return

- Tax-efficient investing in retirement

- Have a plan

How much do you need for a comfortable retirement?

It’s a common mistake to not consider the income you need in order to retire in a way that suits you.

The Pensions and Lifetime Savings Association (PLSA) and the University of Loughborough carried out extensive UK based research, and concluded that a single individual requires £37,300 per annum (p.a.) and a couple require £54,500 p.a. for a ‘comfortable’ retirement.

They define this as “a lifestyle that allows you to be more spontaneous with your money. You could have a subscription to a streaming service, regular beauty treatments and two foreign holidays a year.”

There is a glaring issue with the above — it’s too generic. Your idea of a ‘comfortable’ retirement is likely completely different to others!

You may believe that four weeks of holiday a year in retirement is the bare minimum, and feel an income of c. £80,000 – £100,000 is more realistic. A more accurate approach is to take time with an adviser to analyse what you spend now, and how this may change in retirement.

If we consider £54,500 p.a. as a guide, the current landscape is fairly disconcerting:

- 21% of over 50s in the UK have no pension savings

- Of the 79% that do, the average pension pot is around £146,000

Assuming a withdrawal rate of 4%, this would provide a disastrous £5,800 p. a. in income. When combined with UK adults having a 33% chance of living past 90-years-old, it’s clear that failing to invest sufficiently for retirement is a major issue.

How much should you have invested at retirement?

The famous 4% rule.

Economist William Bengen’s rule is regularly referenced throughout the financial world. His research determined that, in all circumstances, regardless of when someone retires (over a 50-year period), with annual withdrawals of 4%, the pot would always last 30 years.

If you’re eligible for a full state pension, most people will receive £10,600.20 p.a. at state retirement age. Whilst the ‘triple lock’ is always under threat, it is likely that this will remain protected by inflation for the foreseeable future.

Taking the relevant shortfall and dividing this by 4%, we can provide a rough estimate of the pot required:

| Individual desired income | State Pension | Shortfall | Pot required |

|---|---|---|---|

| £37,300 (PSLA 'comfortable' retirement) | £10,600.20 | £26,699.80 | £667,495 |

| £60,000 | £10,600.20 | £49,399.80 | £1,234,995 |

| £80,000 | £10,600.20 | £69,399.80 | £1,734,995 |

| £100,000 | £10,600.20 | £89,399.80 | £2,234,995 |

| Couple desired income | State Pension | Shortfall | Pot required |

|---|---|---|---|

| £54,500 (PSLA 'comfortable' retirement) | £21,200.40 | £33,299.60 | £832,490 |

| £60,000 | £21,200.40 | £38,799.60 | £969,990 |

| £80,000 | £21,200.40 | £58,799.60 | £1,469,990 |

| £100,000 | £21,200.40 | £78,799.60 | £1,969,990 |

If you’re not eligible for full state pension, you can still estimate the amount you may need using the above tables by adjusting the shortfall accordingly.

If you plan to retire earlier than the state retirement age, you will need to increase these sums substantially. A couple would need significantly more than £1 million in order to retire at 60, for example, (assuming full state pension at 67) if they required an annual income of £54,500.

There are some issues with Begen’s approach:

- It doesn’t consider future return rates

- Although it does allow for inflation, withdrawals could well be for longer than 30 years. Bengen himself has also noted its weakness due to the rule’s inflexibility and more recent inflationary pressures

- It takes all asset classes into account in all scenarios – results would differ greatly for 100% equity portfolios

- It relies on withdrawal rates being consistent

- It assesses markets up to 1976, not accounting for modern market reactions and global changes

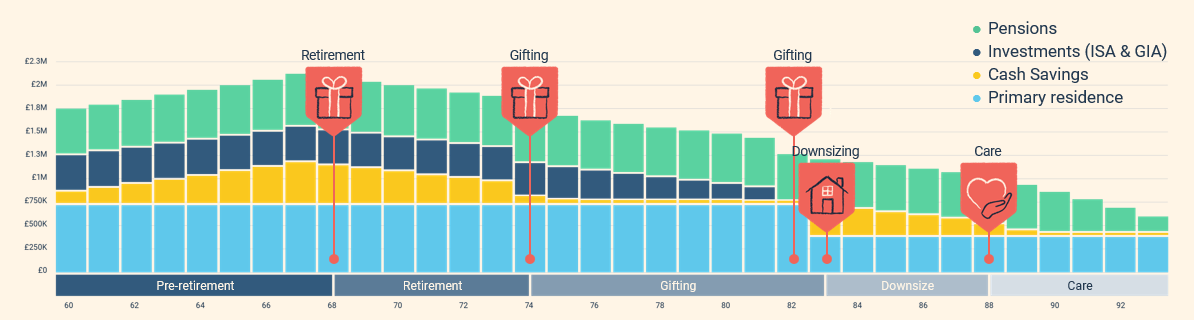

The best method for determining exactly how much you need to invest for retirement is having a bespoke cash flow plan made. This takes into consideration any anticipated capital expenditures and can account for a range of future market returns. Importantly, it can be built around your personal needs and asset base.

A simple version might look something like this:

Making the most of your pension

The impact of tax on your retirement savings can be significant.

Most income earned by a higher rate taxpayer over the £50,270 threshold is taxed at 40% in Income Tax and an additional 2% in NI. As such, if your employer pays you £1,000, it arrives in your bank account as a disheartening £580.

There’s good news – contribute to your pension and you can overcome this.

Most employers pay pension contributions via a method called salary sacrifice. This means that any pension contributions will effectively be made gross of all tax, allowing you to claw back the 40% Income Tax and 2% in National Insurance.

The same £580 contributed to your pension, will receive an immediate uplift of £420 in tax relief, which is a 72% return. This, of course, also applies to basic rate tax payers but the uplift will be the equivalent of a 41% return.

This gets even better if you are an additional rate tax payer. Apply this to the maximum £60,000 contribution you can make to your pension (assuming you aren’t tapered), and you’ll receive £28,200 in tax relief!

Tax-efficient investing in retirement

Pensions are excellent vehicles for growing wealth and with the removal of the lifetime allowance now more so than ever. However, Diversifying your tax wrappers is just as vital as diversifying your investments.

Our Chartered Financial Planners regularly refer to a theory known as the ‘four-box principle.’ It offers a helpful approach to minimising the tax you pay on your retirement income.

It focuses on four core tax wrappers — hence the name.

These tax wrappers have various uses and benefits, that are applied differently, depending on whether you are accumulating wealth or drawing on your assets. In order, these are:

| Tax Wrapper | Contribution | Growth | Withdrawal |

|---|---|---|---|

| Self-Invested Personal Pension (SIPP) | Gross of all tax (if salary sacrifice) | Tax free environment | 25% tax free & 75% taxed at marginal income rate |

| Individual Savings Accounts (ISA) | Net of Income Tax and NI | Tax free environment | Tax free |

| General Investment Account (GIA) | Net of Income Tax and NI | Income, gains and dividends taxable at respective marginal rates | Gains over and above £6,000 Capital Gains Tax (CGT) allowance taxed at marginal CGT rate |

| Offshore Bond | Net of Income Tax and NI | Tax Free environment | 5% p.a. of initial capital tax deferred allowance. Gains taxed as income in line with marginal rate |

Despite its complexity, if you make effective use of all four in the right combination, it really can have a liberating effect on your wealth.

For example, a couple with £2,000,000 invested that want to take around £85,000 a year in retirement, can access every penny of this completely free of tax by using the ‘four box principle.’ The couple have structured their assets wisely and the makeup of their wealth is as follows:

| Wrapper | Partner 1 (value) | Partner 2 (value) | Total |

|---|---|---|---|

| SIPP | £400,000 | £350,000 | £750,000 |

| ISA | £370,000 | £130,000 | £500,000 |

| GIA | £250,000 | £250,000 | £500,000 |

| Offshore Bond | £250,000 | - | £250,000 |

| Total | £1,270,000 | £730,000 | £2,000,000 |

As previously mentioned, (after 25% tax free cash is taken) withdrawals from a pension are taxed as income, in line with the couple’s marginal rate. Both have a personal allowance of £12,570, which means that £25,140 of income can be accessed from their pensions completely tax free.

This level of available tax-free income won’t change once their state pension commences; it simply means that £21,000.40 will be provided by the state with the balance being funded from their SIPPs.

In addition, all withdrawals from their ISAs can be taken without any tax implications. Five per cent of their initial capital (£12,500) can also be accessed from their Offshore Bond each year without any immediate tax implications.

They can make also use of their combined Capital Gains Tax allowances of £12,000 to access £20,000 of funds from their GIA without paying tax. Using this allowance can be confusing to people: assuming a 4% growth rate on their £500,000, the couple’s gain in year one will be £20,000. If they wanted to ‘fully crystallise’ this £20,000 gain, they would have to sell all £520,000 of their investments. The couple can crystallise £12,000 (60%) of this £20,000 gain tax free. This means the couple could access up to £300,000 (60% of £500,000) of this pot without tax implications if they wished. However, as they want to sustain this income for the long term, they choose to only access £20,000 per annum which is easily achievable by using their allowances.

As such, their £85,000 requirement can be fulfilled tax free by drawing income across their various pots:

| Wrapper | Withdrawals | Tax |

|---|---|---|

| Pensions | £25,140 | £0 |

| ISA | £27,360 | £0 |

| GIA | £20,000 | £0 |

| Offshore Bond | £12,500 | £0 |

| Total | £85,000 | £0 |

Have a plan

As you’ve probably come to realise, there are a number of areas to consider when preparing for retirement. It’s important to draw these all together and have a clear, written plan in place.

The plan should start with your goals and be supported by cashflow modelling to determine if you have sufficient assets to meet them. Once you have something clear to aim for, you can then determine how much you need, which tax wrappers you should invest in, how best to structure your assets and how much risk you may need to take. Planning for retirement effectively can have a profound effect on your quality of life. With this in mind, it really should be a priority to take advice and ensure you have sound foundations in place.

What our clients have to say about us...

Article sources

Editorial policy

All authors have considerable industry expertise and specific knowledge on any given topic. All pieces are reviewed by an additional qualified financial specialist to ensure objectivity and accuracy to the best of our ability. All reviewer’s qualifications are from leading industry bodies. Where possible we use primary sources to support our work. These can include white papers, government sources and data, original reports and interviews or articles from other industry experts. We also reference research from other reputable financial planning and investment management firms where appropriate.

Saltus Financial Planning Ltd is authorised and regulated by the Financial Conduct Authority. Information is correct to the best of our understanding as at the date of publication. Nothing within this content is intended as, or can be relied upon, as financial advice. Capital is at risk. You may get back less than you invested. Tax rules may change and the value of tax reliefs depends on your individual circumstances.

About Saltus?

Find out more about our award-winning wealth management services…

Winner

Best Financial Advisers to Work For

Finalist

Investment Performance: Balanced Portfolios

Finalist

Financial Planning Firm of the Year: Small to Medium Firm

Winner - Silver

Financial Planning Firm of the Year (Large)

£4.4bn+

assets under management

20

years working with clients

200+

employees

98%

client retention rate